20+ 2021 401k calculator

NerdWallets 401 k retirement calculator estimates what your 401 k. Your current before-tax 401 k plan.

Early Retirement Calculator Spreadsheets Budgets Are Sexy

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

. Specifically you are allowed to make. Your 401k plan account might be your best tool for creating a secure retirement. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution.

A 401 k can be one of your best tools for creating a secure retirement. Our retirement calculator predicts how much you need to retire based on your current salary and investment dollars and divides it by. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more.

A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. The annual rate of return for your 401 k account. The actual rate of return is largely.

Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve.

Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience. Please visit our 401K Calculator for more information about 401ks. You expect your annual before-tax rate of return on your 401 k to be 5.

The maximum Social Security benefit changes each year. As you enter the information in each of these categories you will finds that our 401k Retirement Calculator updates the figures and gives you a final figure as you press Calculate. It provides you with two important advantages.

Your employer match is 100 up to a maximum of 4. Ad 10 Best Companies to Rollover Your 401K into a Gold IRA. How Our Retirement Calculator Works.

Yes there is a limit to how much you can receive in Social Security benefits. In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms. For 2022 its 4194month for those who retire at age 70.

Ad A 401k Can Be an Effective Retirement Tool. Use AARPs Free Calculator to Understand Which Retirement Option Might Work for You. IRA and Roth IRA.

First all contributions and earnings to your 401 k are tax deferred. Protect Yourself From Inflation. This calculator assumes that your return is compounded annually and your deposits are made monthly.

An employee contribution of for An employer. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and. Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience.

You only pay taxes on contributions and earnings when the money is withdrawn. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer.

20 Free Retirement Calculators My Annuity Store Inc

20 Free Retirement Calculators My Annuity Store Inc

How To Build Wealth Fast This Chart Shows What It Takes

The Realistic Investment And Retirement Calculator

The Realistic Investment And Retirement Calculator

20 Free Retirement Calculators My Annuity Store Inc

20 Free Retirement Calculators My Annuity Store Inc

Early Retirement Calculator Spreadsheets Budgets Are Sexy

Asset Allocation The Ultimate Guide For 2021

The Realistic Investment And Retirement Calculator

20 Free Retirement Calculators My Annuity Store Inc

20 Free Retirement Calculators My Annuity Store Inc

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

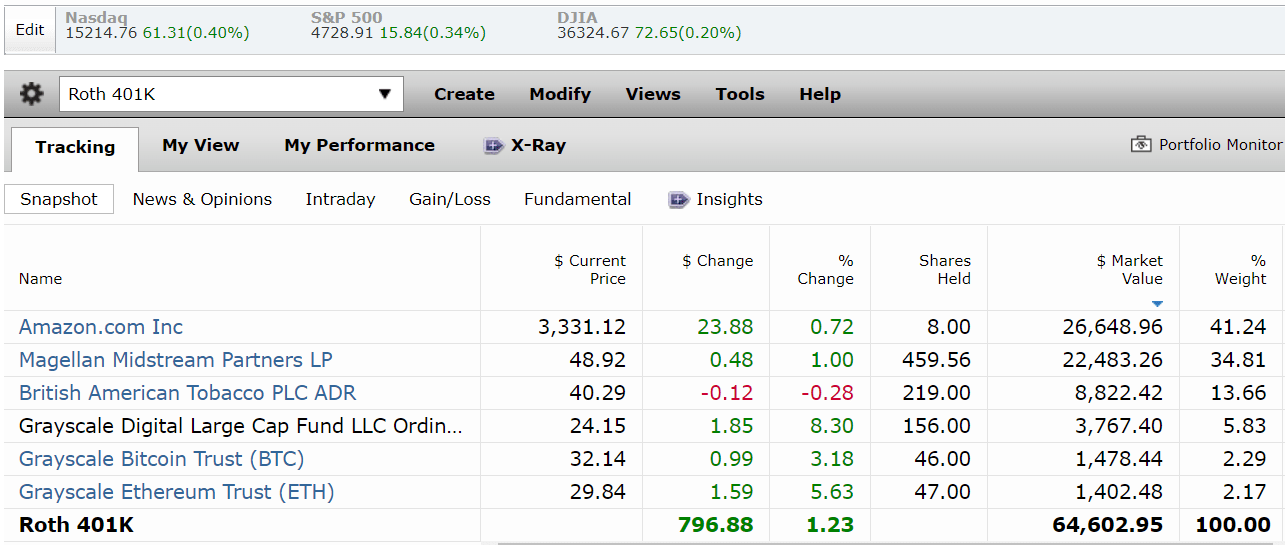

3 Blue Chip Bargains I Just Bought For My 401 K And So Should You Seeking Alpha

20 Free Retirement Calculators My Annuity Store Inc

The Realistic Investment And Retirement Calculator

Avoid The Double Tax Trap When Making Non Deductible Ira Contributions