30+ Front end debt to income ratio

Lenders prefer a back-end DTI ratio lower than 36 and no more than 28 for. In this example lets say that your monthly gross household income is 3000.

Bank Debt Vs Bonds Types Of Debt Financing Securities

Suppose you have other income of 5000 for a total of 6125.

. Report looks at mortgage debt to income ratio. This debt ratio consists of ONLY the projected monthly mortgage payment divided by your gross. The lender must document the additional debt s and reduced income in accordance with B3-6-01 General Information on Liabilities or B3-3 Income.

View Your 3 Bureau Credit Report All 3 Credit Scores On Any Device. If a homeowner has a mortgage the front-end DTI is typically calculated as housing expenses such as mortgage payments mortgage insurance etc divided by gross income See more. Back-End Ratio All Monthly Debt Gross.

You can add 1125 to the income side and must add 1000 to the debt side of your ratio calculation. Theres a specific formula for working out front-end debt-to-income ratio. To see your DTI percentage multiply that by 100.

Front-End Ratio Monthly Housing Debt Gross Monthly Income. Front-End DTI Housing Expenses Gross Monthly Income 100 textleftfractexttextright100. Ad Get Your Full 3 Bureau Credit Report Scores Plus Much More.

The front end debt-to-income ratio is a calculation that takes the monthly gross income divided by the mortgage payment including taxes insurance mortgage insurance fee and any other. Divide 900 by 3000 to get 30 then multiply that. The front-end debt-to-income DTI ratio is avariation of the DTI that calculates how much of a persons gross income is going towardhousing costs.

The maximum DTI ratio varies. Lenders generally look for the ideal front-end ratio to be no more than 28 percent and the back-end ratio including all monthly debts to be no higher than 36 percent. Your front-end debt ratio can also be called your mortgage-to-income ratio.

Your monthly debt payments would be as follows. 1200 400 400 2000. To determine your DTI ratio simply take your total debt figure and divide it by your.

If your gross income for the month is 6000 your debt-to-income ratio would be 33 2000. However for FHA there is a maximum front end and back end debt to income ratio requirement to get an approveeligible per Automated Underwriting System Approval. The debt-to-income ratio is a tool used by lenders to determine if you can afford the house or not.

Front End Ratio Example. To calculate debt-to-income ratio divide your total monthly debt obligations by your gross monthly income. What Is The Dti Preferred By Lenders.

This calculator uses the following formulas to calculate debt-to-income ratios.

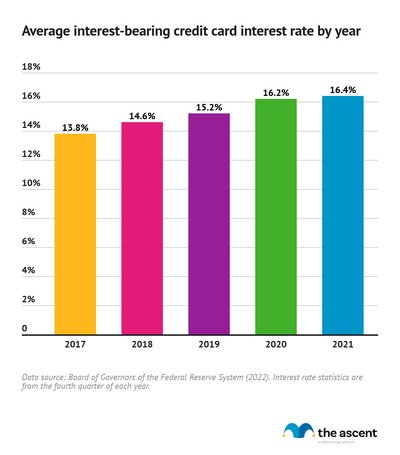

Credit Card Debt Statistics For 2022 The Ascent

Ex 99 2

Loaddocument Php Fn Exhibitb2022globalequityoutlook Png Dt Fundpdfs

Is Rent Included In Debt To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

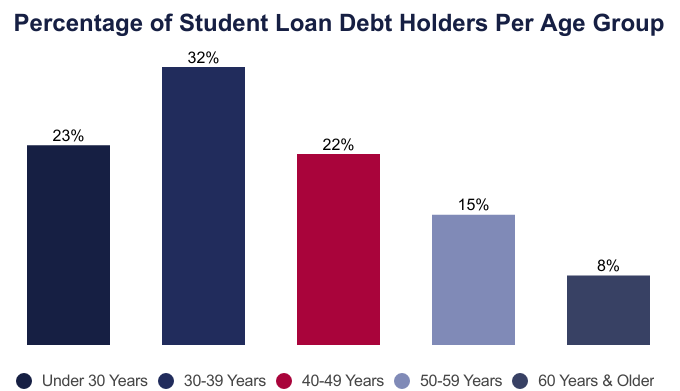

Average Student Loan Debt By Age 2022 Facts Statistics

Nope Auto Loan Delinquencies And Repos Are Not Exploding They Rose From Record Lows And Are Still Historically Low Wolf Street

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

What Is The Debt Payment To Income Ratio Quora

Form N Csr Priority Income Fund For Jun 30

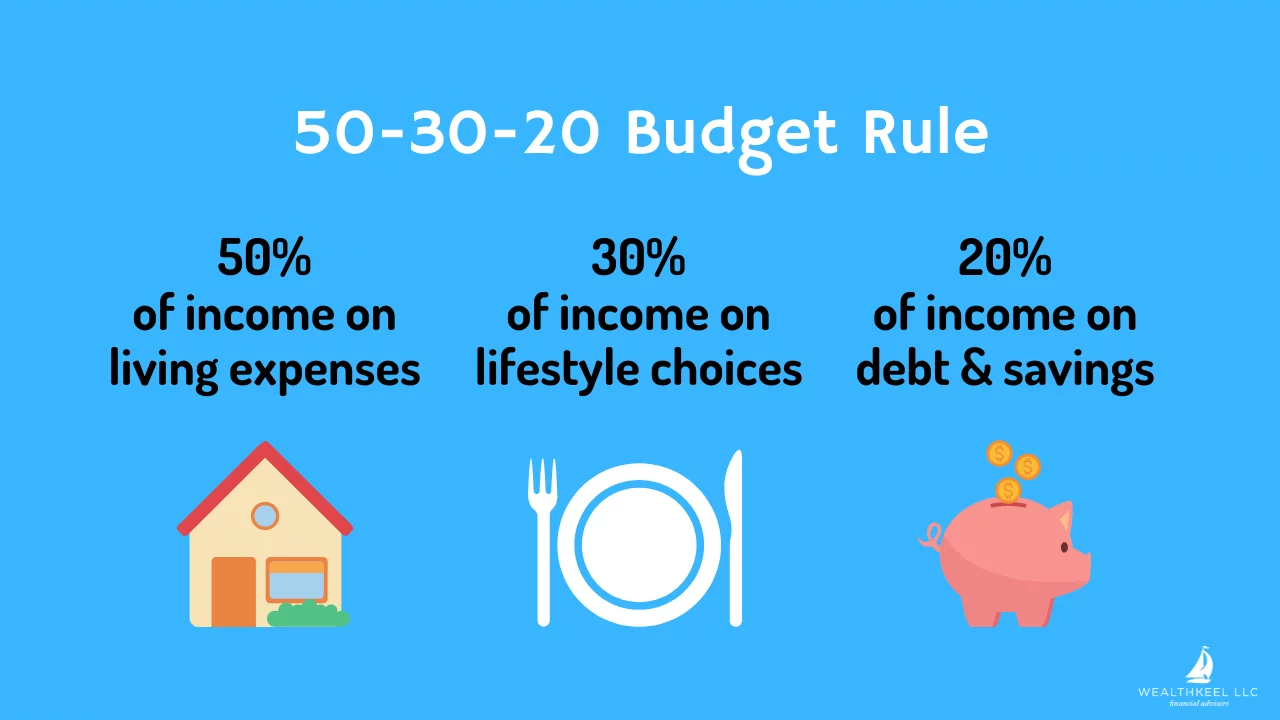

How Much Do I Need To Retire As A Physician Wealthkeel

Cmbs Disputes On The Horizon April 2021

Why Are Interest Rates So Low

Filtering Oregon Office Of Economic Analysis

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go