Semi monthly payroll calculator

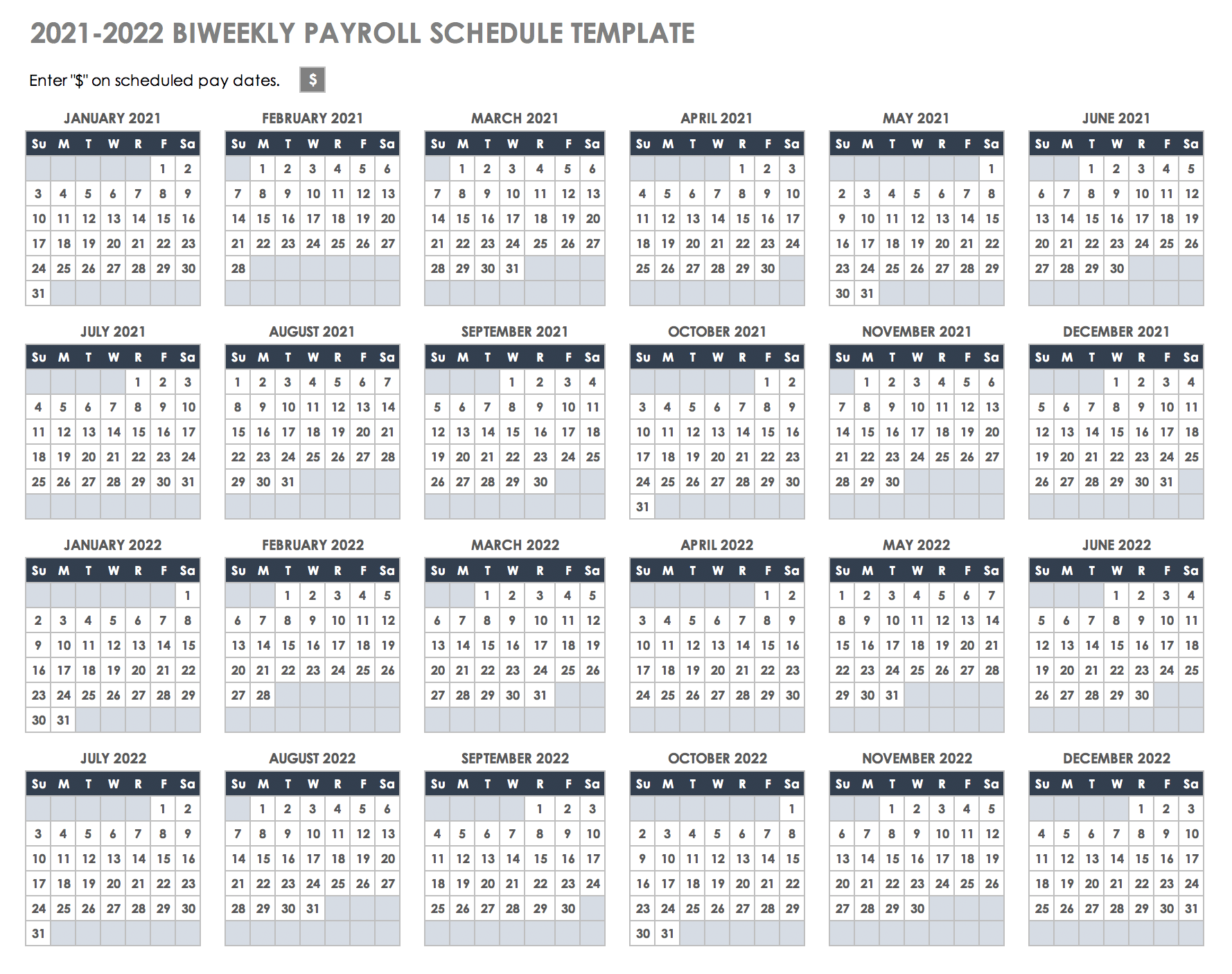

How often is semi monthly. 123022 Future Calendar Year 2023 Bi-Weekly Payroll Schedule Annual Salary.

15 Free Payroll Templates Smartsheet

Total hours in workweek.

. The Total Number of Hours Worked 5. A bi-weekly every other week pay period results in 26 paychecks in a year. Businesses distribute paychecks on set dates but the day of the week will vary from month to month.

Biweekly Payroll Calculator. Current Calendar Year 2022 Semi-Monthly Payroll Schedule Annual Salary. Split your wage into hourly daily weekly semi-weekly monthly bi-monthly and yearly income.

70 hours x 10 700 your gross semi-monthly pay. You can use the calculator to compare your salaries between 2017 and 2022. Examples of payment frequencies include biweekly semi-monthly or monthly payments.

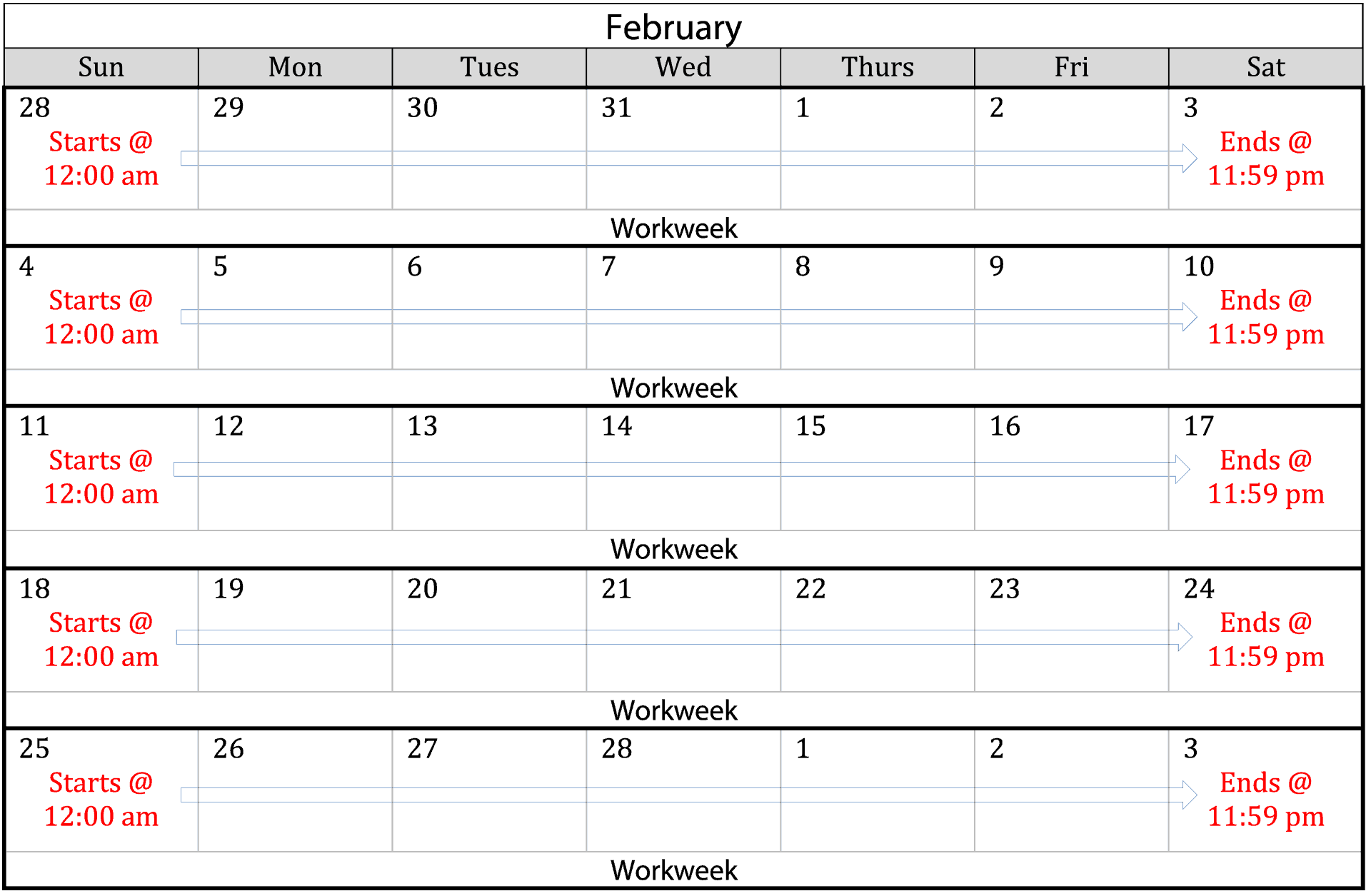

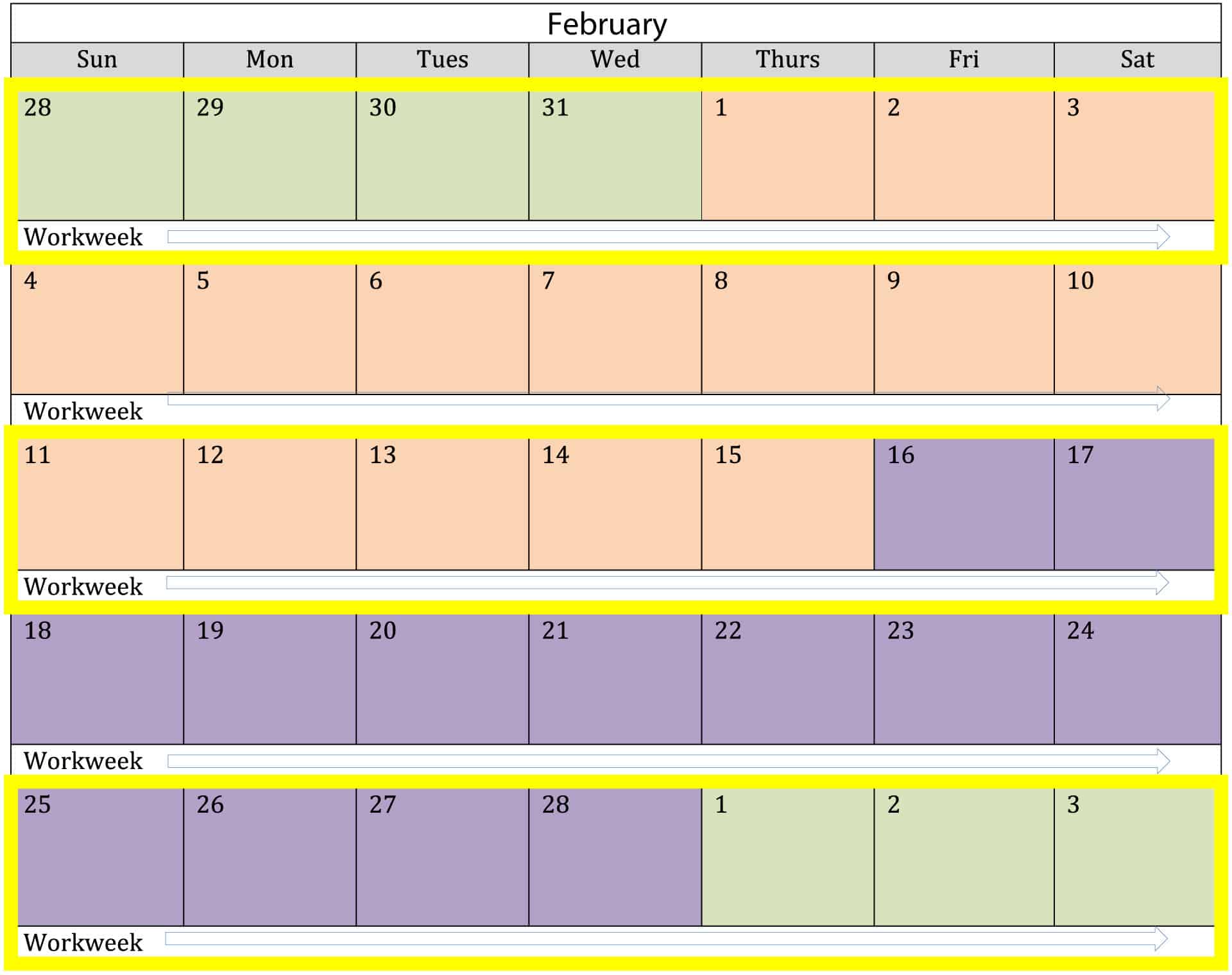

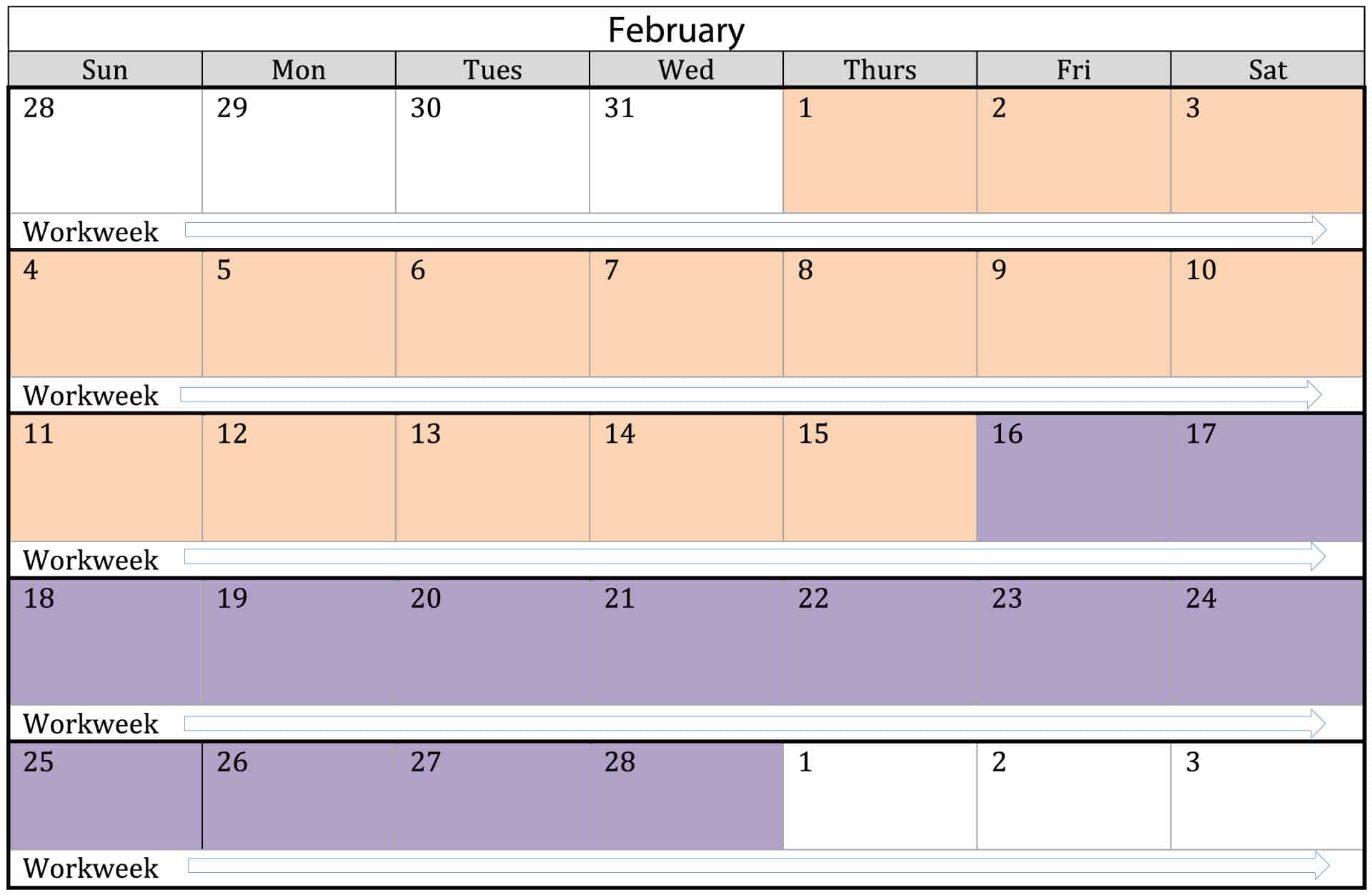

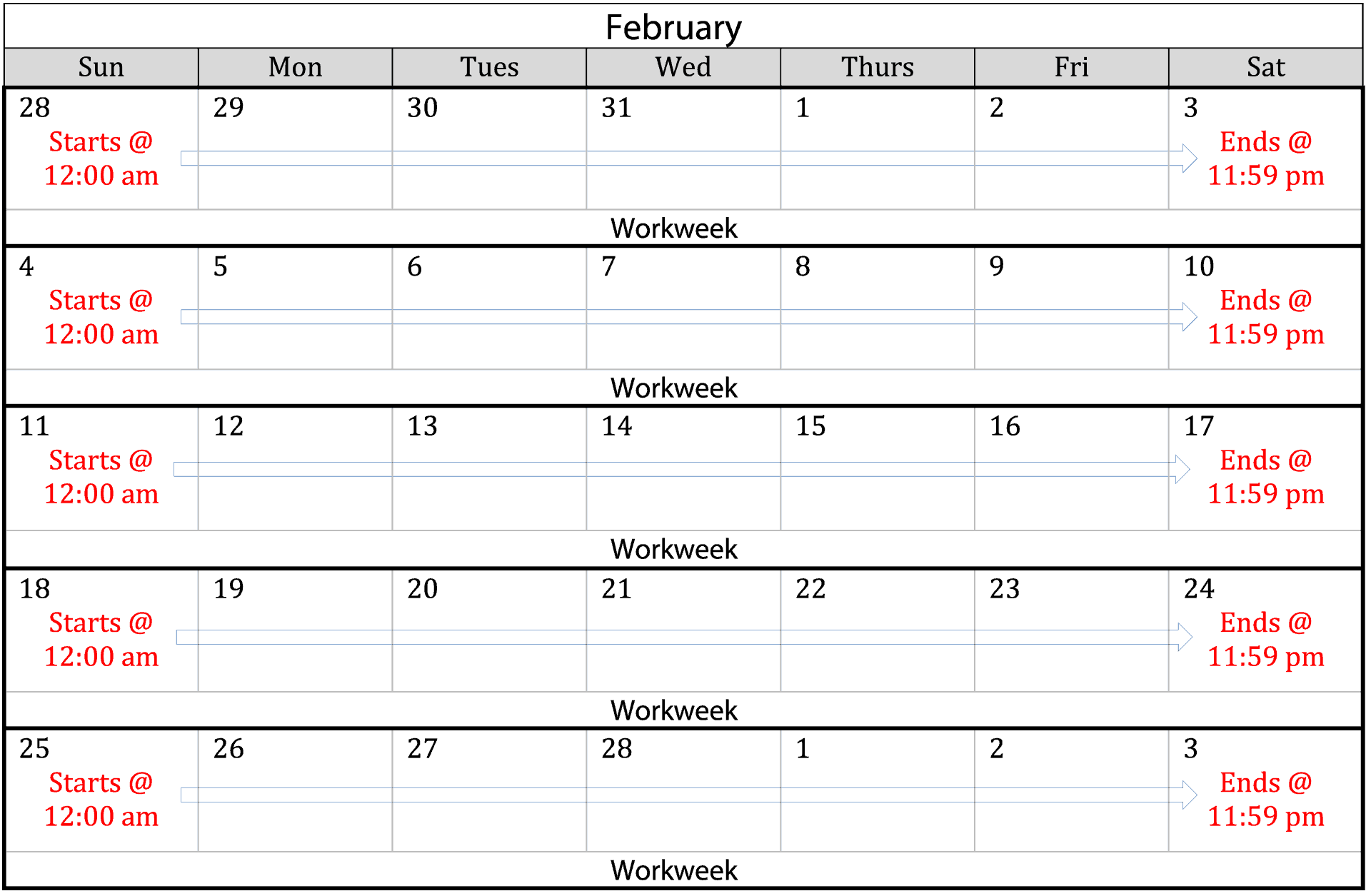

Business days are defined as days other than weekend and University holidays. Content updated daily for semi monthly payroll calculator. Separate into Workweeks 2.

Semi monthly pay is twice a month. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Pay Period Beginning Date Pay Period Ending Date Payday.

A semi-monthly payroll is when a company distributes paychecks twice a month. Pay dates are commonly the first and fifteenth of each month or the fifteenth and last day of each month. A schedule of regular payments twice a month usually on the 1st and 15th of the month.

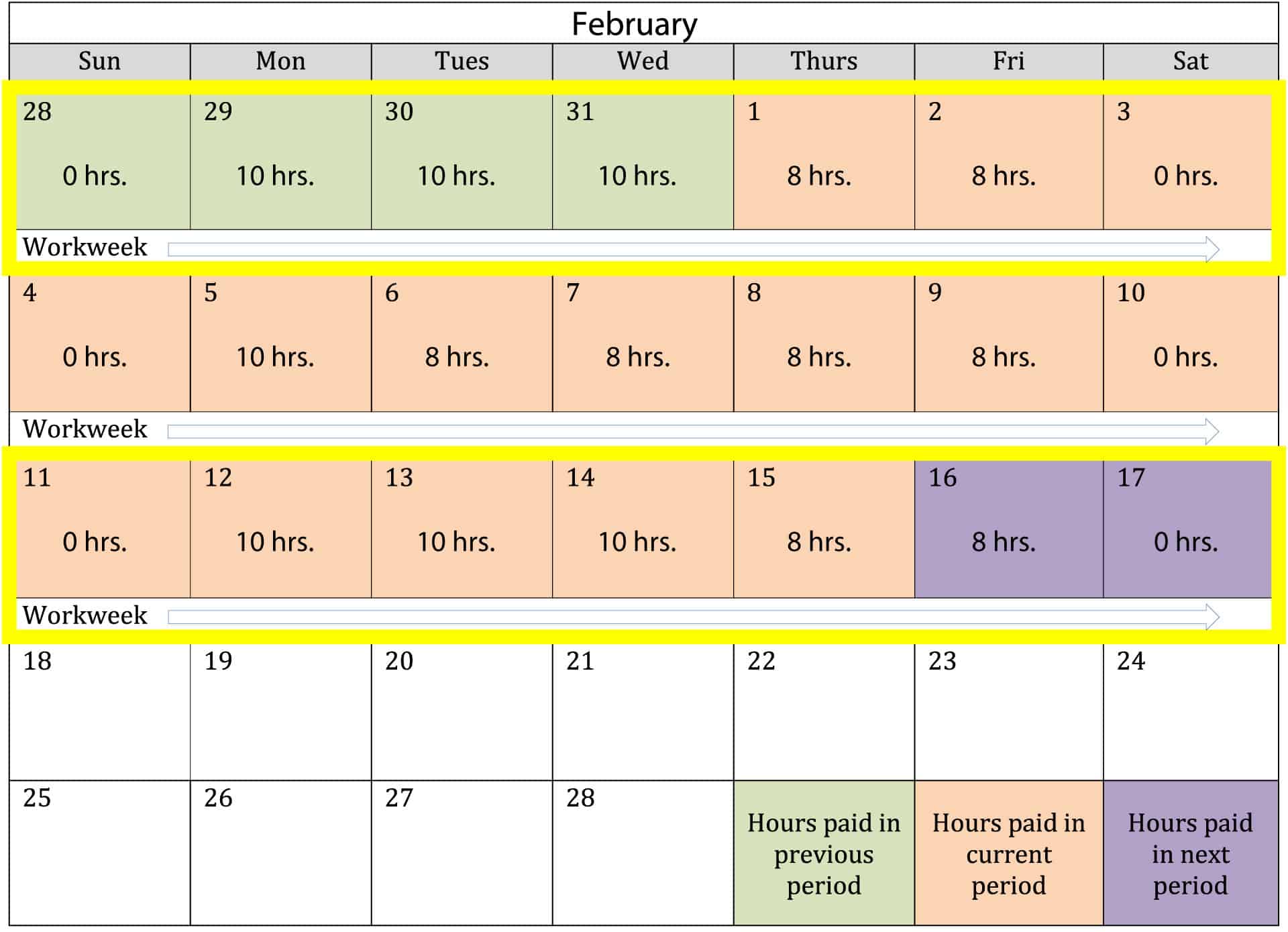

5000 semi-monthly salary 208024 pay periods 8667 hrspay period An employee started 82008 816-83108 10 working days This way the hourly rate stays consistent which makes more sense to me. On a semimonthly schedule the employees gross pay per paycheck would be around 229167. Addition Overtime Conclusion How.

If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary. Total Pay Checks. Salary employees are paid on a monthly pay period basis.

The Addition of the Second Workweek 4. How to Calculate Overtime for a Semi-monthly Payroll 1. Total hours for pay period.

A weekly pay period results in 52 paychecks in a year. Usage of the Payroll Calculator. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency.

401k 125 plan county or other special deductions. Add the hours worked for the first workweek of the payroll period. Examples of pay periods are.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Sounds simple enough right. Flexible hourly monthly or annual pay rates bonus or other earning items.

Gross Pay Per Check. What is a benefit holiday. What does semi monthly pay mean.

Ad Compare This Years Top 5 Free Payroll Software. Lets say there is 8 pay periods left for the year. Employers can use it to calculate net pay and figure out how much to withhold so you can be confident about your employees paychecks.

Total the Hours Worked for the Week 3. For example if you typically contribute 100 in each semi-monthly payroll for a total of 2400 per year you will end up contributing 2600 for the year when your pay frequency changes to bi-weekly. To calculate their semimonthly or biweekly pay divide the employees gross annual pay by the number of pay periods in the year.

Divide that number by 2 and you have the semi-monthly salary. The calculator is updated with the tax rates of all Canadian provinces and territories. Free Unbiased Reviews Top Picks.

Dividing the total yearly salary by 12 will give you the gross pay for each month. Pay Period Gross Pay Cumulative Pay. For the second workweek add the number of hours worked in the pay period and subtract 40.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Due to the nature of hourly wages the amount paid is variable. Free Unbiased Reviews Top Picks.

Public employees exempt employees paycheck. Semi-Monthly A semi-monthly payment frequency results in 24 total paychecks per year. Below is an example of how an employer would calculate overtime hours in a semi-monthly pay period.

Begins Ends Pay Date 121622. In Workweek 1 we can see that Jack Black worked a total 46 hours 6 of which are overtime. Weekly bi-weekly semi-monthly and monthly.

This will typically happen on the 15th and 30th or 31st totaling 24 paychecks for the whole year 2 less than the bi-weekly model. You can make changes to your TIAA contributions on the TIAA website or app. Calculate and Divide Multiply hours worked by your hourly rate.

Were bringing innovation and simplicity back into the Canadian payroll market. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. The yearly salary will be divided by 24 to get the payments.

For example if you make 3000 per month you would get paid 1500 semi monthly or twice a month. Calculate your paycheck withholdings for free. Trusted by thousands of businesses PaymentEvolution is Canadas largest and most loved cloud payroll and payments service.

Usually a monthly payment frequency is used for salary employees but hourly employees can be paid monthly as well. Computes federal and state tax withholding for paychecks. On a biweekly schedule the employees gross pay per paycheck would be about 211538.

Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year. A semi-monthly twice a month pay. All monthly paydays are the first business day of the following month of the pay period.

To cross check this is what I would do. Divide the semi-monthly payroll period into workweeks determined by your employer. The amount can be hourly daily weekly monthly or even annual earnings.

Enter your annual salary. Semimonthly payroll produces 24 consistent paychecks per year. Monthly Payroll Calendar.

Total Pay Checks. Salaried Formula Use the salaried formula if you are a salaried employee. Accountants bookkeepers and financial institutions in Canada rely on us for payroll expertise and payroll services for their clientele.

A semimonthly payroll pays employees two times every month. For instance if you worked 70 regular hours during the semi-monthly pay period and earned 10 per hour you would calculate as follows. Divide the annual salary by 24 to get the gross pay for one semi-monthly period.

So what are the big differences. Ad Compare This Years Top 5 Free Payroll Software. Enter your pay rate.

Semi-monthly salary remaining pay periods. On fixed salary calculate half of 1 months salary. How to calculate taxes taken out of a paycheck.

10 Regular 6 OT. The calculator is updated with the tax.

![]()

Download Free Bi Weekly Timesheet Template Replicon

Free 10 Monthly Timesheet Calculators In Google Docs Pages Ms Word Pdf

How To Generate Weekly Dates From Bi Weekly Pay Period In Excel Super User

Payroll Calculator Free Employee Payroll Template For Excel

Free 10 Monthly Timesheet Calculators In Google Docs Pages Ms Word Pdf

Excel Formula Next Biweekly Payday From Date Exceljet

4 Ways To Calculate Annual Salary Wikihow

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Free 9 Sample Biweekly Timesheet Calculators In Ms Word Excel Pdf

Semi Monthly Timesheet Calculator With Overtime Calculations

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Payroll Formula Step By Step Calculation With Examples

Calculation Of Federal Employment Taxes Payroll Services

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Elaws Flsa Overtime Calculator Advisor

The Pros And Cons Biweekly Vs Semimonthly Payroll